Decision tree analysis is a valuable tool for evaluating settlement options in mediation. It’s a tactic we employ with even the most mundane decisions. For instance, as we consider crossing a busy street, we’re unconsciously weighing the “reward” of being across the street — along with our probability of safe passage — against the risk involved.

Similarly, effective litigators assign probabilities for success, and their clients’ potential for recovery (or, alternately avoidance / minimization of recovery), versus the consequences of losing before they take action.

I regularly use decision analysis in mediations to help parties evaluate litigation alternatives as a means of reality testing. Decision trees can be complex — incorporating any number of events which may, or may not, transpire during litigation — or they can be as simple as factoring the probability of winning or losing at trial.

Your Analysis is Only As Good As Your Data

Although there’s always imprecision in projecting probabilities for events in the litigation process, our own experience (and often the experience of others) enables us to make predictions with some degree of confidence.

I recently mediated a case in which the Plaintiff sued for $1 million for breach of the contract. The Plaintiff contended that his chances of winning the entire amount at trial were about 50/50. The Defendant disagreed. He argued that the Plaintiff had a 30% chance of prevailing at trial. I suggested we apply the contrasting projections to a compromise — assigning a 40% probability of success to the Plaintiff; which gave case a hypothetical value of $400,000. Although the case didn’t settle for that amount, the amount provided a baseline point of reference for evaluating both sides’ demands and offers.

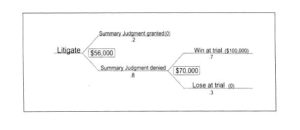

Now let’s apply that logic to a personal injury case: If a Plaintiff thinks he can has a 70% chance of trying, and winning, (for the sake of readability) $100 — and that his request for summary judgment has an 80% chance of being denied — his decision tree would look like this:

The expected value of the case can be calculated by multiplying $100 x 70% ($70) — then multiplying that amount by 80% (the probability that summary judgment would be denied) or $56.

Decision analysis is not the valuation Be All and End All. For starters, the numbers you’re using in the process typically come from “educated guesswork”.

Moreover, the process doesn’t account for risk aversion or intangible factors such as fear and anger — or cost of litigation — which should be a separate part of your analysis. Nevertheless, a decision tree can still be an excellent tool for valuing litigation alternatives, factoring risks at the various points in the litigation process, and determining how those risks should impact one’s evaluation of a case.

Finally, it can also be used to explain the risk/reward analysis to your clients as they seek to make wise decisions.

I used this method with a client today. Good post!